Despite this, you still need to be a smart customer when picking a health insurance plan protection provider, and you should do some things before purchasing insurance plan protection.

Health and fitness insurance: Research your options first

There are hundreds if not thousands of different insurance companies out there. Because of that, it is important for you to look at a dozen or more. This may be a daunting task but it is really worth it. A lot of magazines like Consumer Affairs do some of the rating work for you, which means that you will be able to spend less time doing the research yourself. However, you still need to make sure that your companies are trustworthy and will pay you back when you need them to and do not breach your contracts.

Don't be cheap

While there are some pretty good cheap insurance plans out there that definitely beat not having any insurance whatsoever, the bottom line is that you really do not want to have to get a cheap insurance plan because you get what you pay for in the world of insurance. That means that if you walk down to your local insurance office and buy the cheapest plan they have, you will not be well covered and it might be so bad that it will be like not having any insurance at all. On the other hand, if you shop around for cheap insurance online then you will have better insurance than you would have had if you went down to the local insurance office and bought some cheap insurance there.

Cheap health insurance

Cheap health and fitness insurance is not necessarily advisable per se but it can be necessary. When you buy one of these plans, one thing you really should look out for is the maximum yearly coverage plan. Some of the least expensive plans cover only up to $1000 of dental work (or exclude dental and/or vision altogether), which might be enough to get four or five cavities filled and pay for between half and a third of a root canal. This should be enough for one individual but if you have more serious teethwork then you might need to pay for it out of pocket.

Don't have holes in your insurance plan protection coverage

Some individuals try to “save money” by not being guaranteed for a bit, but this actually makes you more expensive to guarantee subsequently because the plan protection providers will worry that something may have occurred to you while you were off protection. Also, even though they are prohibited to reject protection for pre-existing conditions, they might still try to not pay for it and neglect the law permanently, or claim that it is the liability of a prior insurance company.

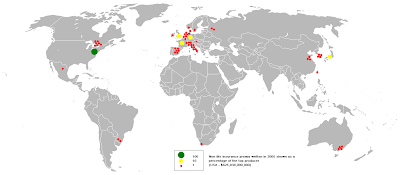

Image copyright note: This image is in the public domain, and was found here on the Wikimedia commons.

Thanks for all the advice and information about what to do before purchasing a health insurance policy. I am trying to obtain a policy that will cover all my needs and costs me within my budget. I hope all these tips will help.

ReplyDeletebusiness insurance